e-Invoicing System in Poland

Poland is one of the EU countries that introduces central clearance model following the footsteps of Italy. In this context, the Polish government has introduced a centralized platform called “PEF” (Platforma Elektronikznego Fakturowania) for the implementation of the B2G invoicing in April 2019, and another platform “KSeF” (Krajowy System e-Faktur) for the implementation of B2B and B2C invoicing in October 2021.

The mandatory transition to e-invoicing in B2G billing has already been completed in 2019. On the other hand, transition to B2B e-invoicing will be mandatory from 1 January 2024.

B2B Invoices

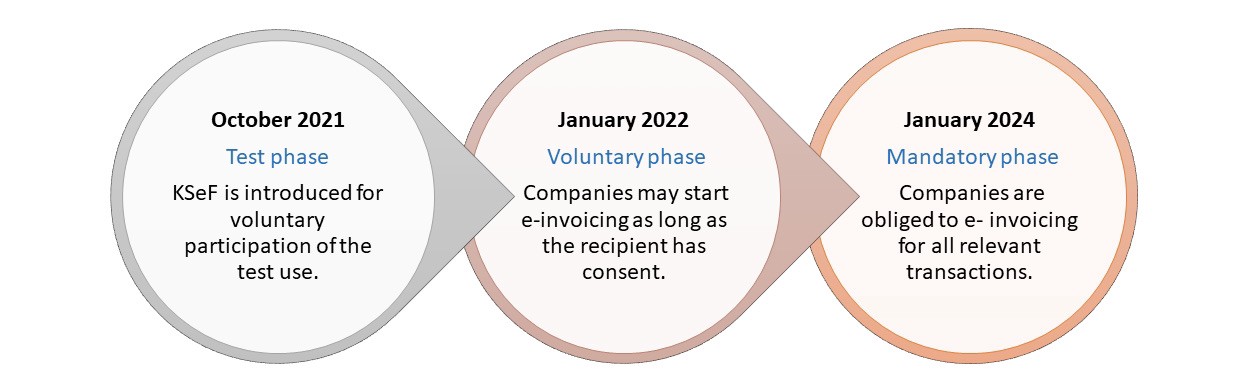

Poland takes gradual steps to ensure that the transition to the new regime and the adaptation of the tax payers would be smooth. To that end, the government first introduced the test phase in October 2021 and have started to implement voluntary e-invoicing model, where the acceptance of recipient is required, as of January 2022.

European Commission has approved the request of the Polish government authorizing to implement an obligation to issue electronic invoices, processed through The National System of e-Invoices (KSeF) on 30 March 2022. With the approval of the Commission, this July it was decided that Poland will make the transition to mandatory e-invoicing from January 1, 2024.

Phases of Project Roll Out

The scope of obligation is limited to taxable persons established in the territory of Poland for all transactions that require the issuance of an invoice according to Polish VAT legislation.

The motivation of the government for the introduction of this obligation is to facilitate VAT collection, combat with VAT fraud and accelerate the public digitalization. The new system will also have benefits to tax payers such as ability to see the invoice status, archiving the invoices safer and cheaper as well as increasing the automation of business processes and simplifying compliance with tax obligations. Government also encourages transitions by accelerating VAT refunds, shortening the time interval from 60 days to 40 and exempting the companies to submit JPK_FA files.

Get Ready for Mandatory E-Invoicing in Poland

Starting February 1, 2026, large companies in Poland will be required to issue electronic invoices through KSeF, and from April 1, 2026 this mandate will extend to most businesses. To stay compliant, every company must adopt a solution.

Melasoft offers end-to-end and SAP Add-On e-invoicing solutions designed for Poland. With our sandbox and test environments, you can prepare early and ensure your business is fully KSeF-ready.

Melasoft e-Invoice Package for Poland

Melasoft add-on packages created under Melasoft own namespace and so does not affect the usual business processes of the SAP or other ERP systems. The SAP module users will take the same steps they have taken before and Melasoft add-on automatically will extract the necessary information to create the e-invoice in structured XML format as the VAT code mandates. By transferring the package to your ERP system, the user’s work load in KSeF portal will be eliminated.

E-Invoice Processes

Outbound Cockpit

When the invoice is created in the client’s ERP system, the necessary information will be extracted and XML file in FA (1) format will be created automatically. As the invoice is dropped into our outbound cockpit, you will have options to monitor (both in XML and PDF formats), add notes/attachments, delete or send the invoice to the recipient through intermediary services of KSeF. After the invoice is evaluated in KSeF portal, the status will be updated in the cockpit. If your invoice is not validated for some reason, status will be changed accordingly and you will be able to monitor rejection reason coming from the portal. If the invoice is validated, it’ll be transferred to the recipient’s inbox.

Inbound Cockpit

Our package pulls incoming e-invoices from the KSeF to Melasoft inbound cockpit. The available information is extracted from the incoming XML file in order to parsed into client’s ERP screens. You will have options to view, control, status check, download and mail the e-invoice in XML/PDF formats.

MELASOFT

EUROPE

TURKEY

ASIA – AFRICA

Websites