1. Importance and General Situation of E-invoicing in UAE

The electronic invoicing system in the United Arab Emirates represents a fundamental transformation for the business community. 82% of businesses in the UAE are micro enterprises with annual turnover less than AED 3 million. This situation makes the accessibility of cost-effective technological solutions critical for all businesses.

Strategic Objectives and Vision

The fundamental objectives of the UAE e-invoicing system directly align with the country’s digital transformation vision. The primary goal is to become a key enabler of a modern digital and paperless economy while maximizing the UAE Federal Government’s revenue collection capacity. The system aims to reduce tax gaps and evasion, create a balanced playing field for all businesses, and enhance the ease of doing business.

This strategic approach manifests itself across six key effectiveness areas. In the effectiveness dimension, increasing reporting accuracy and improving audit/compliance processes stand out. From a digitization perspective, reducing human intervention and making the UAE fiscal ecosystem digitally enabled is targeted. From an economic contribution perspective, the contribution of big data analytics to economic growth and competitiveness is aimed for.

Benefits to the Business Community

The concrete benefits that the e-invoicing system offers to the UAE business community span a wide range, starting from enhancing taxpayer experience. While achieving significant reduction of up to 66% in invoice processing costs, cash flows are significantly improved by optimizing invoice cycle time.

In terms of efficiency, objectives such as cost and transaction optimization, reducing processing times, and minimizing paper wastage are achieved. Through standardization and automation, invoices can be delivered to buyers in near real-time, creating opportunities for faster payments.

Compliance and Transparency

The system also enhances financial visibility and provides rich data analysis opportunities for decision-making processes through invoices being available in machine-readable format. In the compliance dimension, reducing the tax gap, maximizing compliance, and tackling the shadow economy are fundamental priorities.

Automatic data reporting to the FTA through UAE Accredited Service Providers enables pre-population of certain fields in VAT returns and expedites refund processing.

2. UAE E-invoicing Implementation Timeline

The UAE e-invoicing system implementation process is planned in phases, establishing a clear timeline for both service providers and taxpayers.

UAE e-invoicing timeline

Official Implementation Schedule

Q4 2024: UAE Service Provider accreditation procedures initiated. This process is critical for establishing the fundamental infrastructure of the e-invoicing ecosystem.

Q2 2025: E-invoicing related legislation updates will be completed. The legal framework will be clarified, ensuring all stakeholders fully understand system requirements.

Q2 2026: Phase 1 goes live with e-invoicing reporting actually beginning. Mandatory implementation will take effect for businesses of certain scales.

Preparation Process for Taxpayers

A six-stage process has been designed for taxpayer system adaptation:

Stage 1-2: Understanding e-invoicing process and data requirements, followed by Accredited Service Provider selection and commercial impact analysis.

Stage 3-4: Implementation of e-invoicing system with selected service provider and conducting comprehensive testing processes.

Stage 5: Accredited Service Provider automatically facilitates e-invoice exchange between supplier-buyer and reports data to FTA.

Stage 6: Full-capacity system utilization targeting business process optimization and cost reduction.

UAE E-invoicing Preparation Process for Taxpayers

3. Integration, Archiving and Technical Requirements

Critical technical requirements and special conditions exist for successful implementation of the UAE e-invoicing system.

Transactions within the Scope

The e-invoicing framework encompasses all business-to-business (B2B) and business-to-government (B2G) transactions. This broad scope demonstrates that the system is designed to comprehensively cover commercial activities in the UAE.

Service Provider Accreditation

The fundamental requirement for service providers seeking accreditation is OpenPeppol membership and compliance with testing requirements. UAE registered company status, minimum AED 50,000 paid-up capital, and at least one year operational history are mandatory. Additionally, mandatory CT registration and compliance with FTA’s data reporting requirements are required.

From a security perspective, multi-factor authentication, data encryption, SOC-E/SOC2 certification, and ISO 22301 business continuity certificate are necessary. Service providers must commit to providing 100 free e-invoices annually and must not be involved in any legal proceedings.

System Infrastructure and Formats

In the infrastructure built on the OpenPeppol system, communication between sender and receiver APs (access points) uses the Peppol AS4 protocol, while the connection between service providers and MoF/FTA is also regulated using the same protocol. Businesses included in the e-invoice platform are listed in the PEPPOL directory, with PINT-AE format used as standard.

Archiving and Special Conditions

QR code printing is not mandatory for e-invoices, and no additional digital signature requirements exist beyond PEPPOL. PEPPOL directory access URLs will be published on FTA/MOF websites, with full compliance to Peppol standards being the fundamental condition in the accreditation process.

4. How E-invoicing Works?

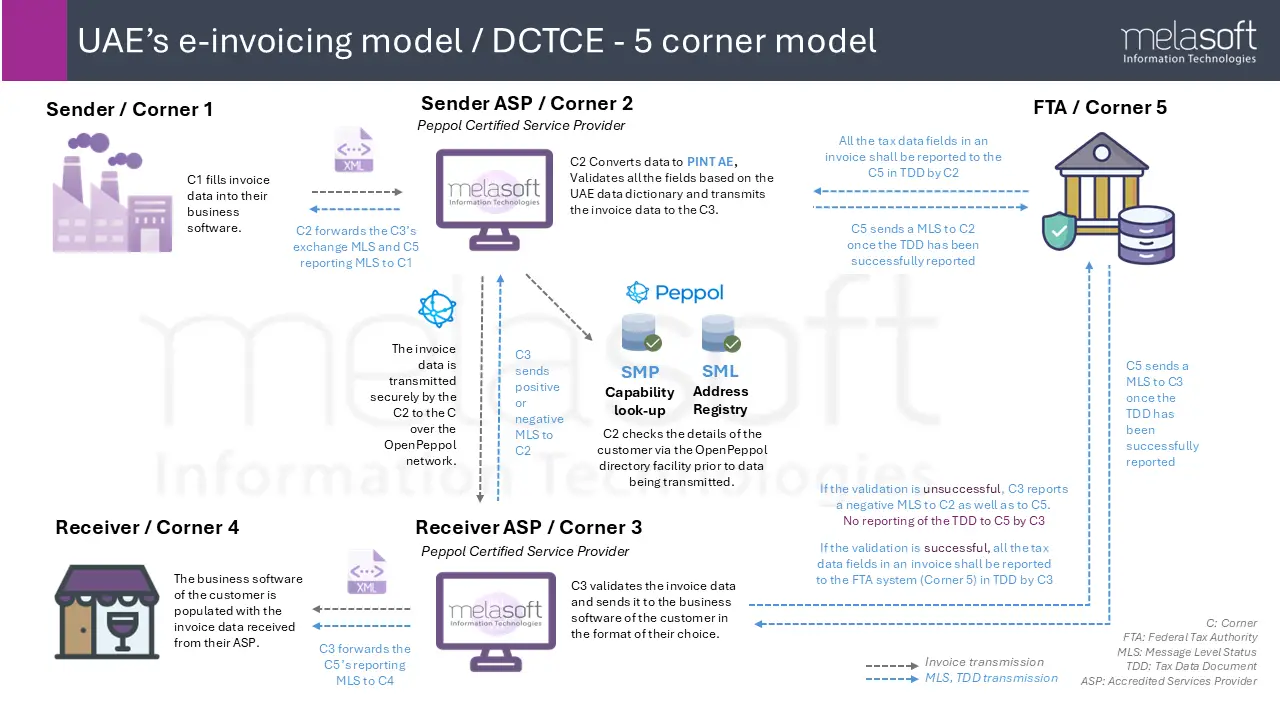

UAE’s e-invoicing model / DCTCE 5 Corner Model

The UAE e-invoicing system operates on a Decentralized Continuous Transaction Control and Exchange (DCTCE) model. This system encompasses a comprehensive process that simultaneously handles e-invoice transmission from supplier to buyer and data reporting to the tax authority.

The process begins with the supplier (C1) sending invoice data in PINT-AE format to their UAE Accredited Service Provider (C2). Service provider C2 validates the received invoice data and converts it to UAE standard XML format when necessary. Following this process, the validated invoice is transmitted in XML format to the buyer’s UAE Accredited Service Provider (C3).

In parallel during the same process, C2 service provider reports the Tax Data Document (TDD) to the tax authority system (C5). This parallel operation guarantees both uninterrupted continuation of the commercial process and ensuring tax compliance.

On the buyer side, after C3 service provider validates the invoice, it sends a Message Level Status (MLS) to the sender side. Subsequently, C3 delivers the invoice to the buyer (C4) in the agreed format with the end user.

When the invoice is successfully validated, C3 service provider also reports its own Tax Data Document to C5. However, if validation fails, C3 sends negative MLS to both C2 and C5, and TDD reporting does not occur in this scenario.

Tax authority system C5 notifies both C2 and C3 separately via MLS that the TDDs have been successfully reported. In the final stage of the process, C2 service provider forwards both the exchange status with C3 and the reporting confirmation from C5 to the supplier (C1). Similarly, C3 notifies the buyer (C4) of the reporting confirmation from C5.

This comprehensive system ensures all parties are simultaneously informed of transaction status while automatically managing tax compliance.

5. Conclusion

The UAE e-invoicing system plays a critical role in the country’s transformation to a digital economy. This transformation, which began with accreditation processes in the last quarter of 2024, will be fully implemented in the second quarter of 2026.

The benefits provided by the system, such as cost reduction of up to 66%, improvement of cash flows, and automation of tax compliance, are of great importance especially for the UAE economy, which is predominantly composed of micro enterprises. The adoption of the OpenPeppol standard will facilitate the integration of UAE businesses into global supply chains and increase international competitiveness.

The system designed with the DCTCE model enables simultaneous execution of commercial transactions and tax reporting, both increasing business efficiency and enabling real-time data access for tax authorities. This will become an important tool in closing the tax gap and combating the shadow economy.

In the future, successful implementation of the system will strengthen the UAE’s digital leadership in the region and serve as a model for other Gulf countries. Timely preparation by businesses and appropriate service provider selection are of critical importance for maximizing benefits from this transformation.